- Healthcare AI News

- Pages

- Q1 2023 Financial report

2023 - Q1 EARNINGS SUMMARY

This analysis focuses on the top 5 leading Health Insurance, Pharma, and Medical devices companies, examining the top five by market capitalization. We will discuss their Q1 earnings, prevailing trends, stock performance, and recent merger and acquisition activity and partnerships.

Medical Insurance, Medical services, and Managed care

United Health Group Inc.

Elevance Health Inc.

CVS Health Corp.

Cigna Group

Humana Inc.

Pharmaceuticals and related segments

Johnson & Johnson

Eli Lilly and Company

Merck & Co., Inc. (NYSE: MRK)

AbbVie, Inc. (NYSE: ABBV)

Pfizer Inc. (NYSE: PFE)

Medical devices, equipment, and hospital supplies manufacturers

Abbott Laboratories

Stryker Corp.

Intuitive Surgical, Inc.

Boston Scientific Corporation

Becton Dickinson and Company

Medical Insurance, Medical Services, and Managed Care

UnitedHealth Group, Inc. (NYSE: UNH)

Q1 FY2023 earnings were solid, with revenue growing by 15% (reported basis) YoY to $91.9 billion.

Earnings from operations: $8.1 billion, reported growth of 16% YoY, operating margin of 8.8%.

Cash flows from operations: $16.3 billion, or 2.8-times net income, adjusted cash flows from operations: $5.1 billion, or 0.9-times net income.

Optum performed well in Q1 FY2023, with revenue growing 25% YoY to $54.1 billion and operating earnings grew 19% YoY to $3.7 billion.

Optum Health revenue per consumer served increased 34% over the year-ago quarter, driven by growth in people served under value-based care arrangements.

Optum Insight's revenue backlog increased by 35% to $30.7 billion compared to a year ago, driven by the addition of Change Healthcare and growth in comprehensive managed services offerings for health systems.

Optum Rx's revenue growth of 15% in the first quarter resulted from advances in serving new clients and further expansion of its specialty and community-based pharmacy offerings.

Full-year 2023 outlook: GAAP net earnings of $23.25 to $23.75 per share, adjusted net earnings of $24.50 to $25.00 per share, organic revenue growth of 10% to 11%.

UnitedHealth's Optum entered a strategic partnership with Northern Light Health in January 2023 "to enhance the health care experience for patients and providers throughout Maine"

The UNH stock price was down 5.73% YTD as of April 25, 2023.

Elevance Health Inc. (NYSE: ELV)

Elevance posted a strong quarter in Q1 FY2023.

Revenue: $41.9 billion, reported growth of 10.6% YoY, organic growth of 11.2% YoY.

Earnings from operations: $2.8 billion, reported growth of 16.6% YoY, operating margin of 6.8%.

Cash flows from operations: $6.5 billion, or 3.2-times net income, adjusted cash flows from operations: $3.5 billion, or 1.7-times net income.

Full-year 2023 outlook: GAAP net earnings of greater than $29.50 per share, adjusted net earnings of greater than $32.70 per share, organic revenue growth of 10% to 12%

Partnerships and other developments: announced a strategic collaboration with Microsoft to accelerate the digital transformation of health care; launched Elevance Health Connect, a new platform that integrates data and insights across its businesses; expanded its value-based care offerings with new contracts and acquisitions; received several awards and recognitions for its innovation and performance.

Share price continues to underperform; it was down 7.82% YTD on April 25.

CVS Health Corp. (NYSE: CVS)

CVS posted strong revenue growth in Q4 FY2022, increasing 9.5% YoY to $83.85 billion. It grew 10.4% YoY to $322.47 billion for the full year 2022.

The Pharmacy Services segment is the company's best-performing business unit in terms of revenues; it earned $43.75 billion in Q4, an 11.2% YoY growth.

The company expects the Retail/LTC segment to earn between $5.95 and $6.05 billion in the full year fiscal 2023. It also expects low to mid-single-digit growth for the Health Care Benefits segment and mid-single-digit growth for the Pharmacy Services segment.

The share price was down 20.96% YTD as of April 25.

Cigna Group (NYSE: CI)

Cigna posted strong growth in the most recent quarter, as well as the full year of fiscal 2022. Total revenues grew to $180.5 billion for the full year against $174.08 billion for the full year 2021.

Evernorth and Cigna Healthcare claimed the biggest share of the company's stellar performance in Q4 and the full year. The former's revenue grew 6%, and the latter's adjusted earnings increased 13% YoY.

The company repurchased $9 billion worth of shares and increased the quarterly dividend rate by 10% to $1.23 per share.

Despite the robust financials and the generosity to investors, the share price was down 20.34% YTD as of April 25.

Humana Inc. (NYSE: HUM)

Revenues grew from $21.05 billion in Q4 FY2021 to $22.44 billion in Q4 FY2022. Also, revenues for the full year 2022 came in stronger than the previous year, at $92.87 billion compared to $83.06 billion.

The insurance segment remains the largest in revenue terms, with the full-year fiscal 2022 earnings of $88.84 billion.

The company posted a net loss per share of $0.12 in Q4, higher than the $0.11 loss earned in Q4 FY2021.

Humana expects the diluted GAAP EPS for the full year 2023 to be at least $27.57; the reported value for the full year 2022 was $22.08.

The stock was up 0.25% YTD as of April 25.

Pharmaceuticals and related segments

Johnson & Johnson (NYSE: JNJ)

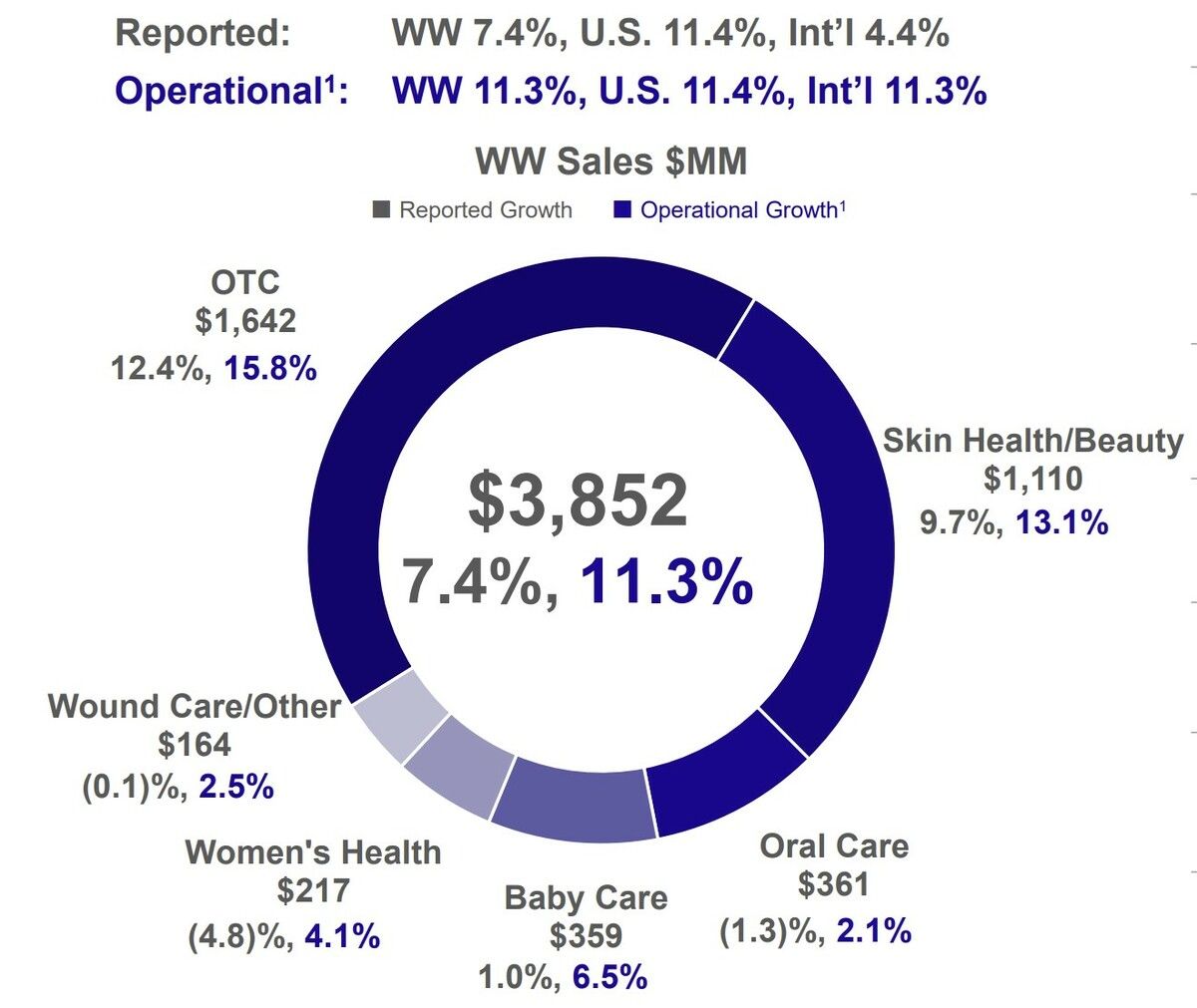

The company posted solid Q1 FY2023 earnings.

Revenue: $24.7 billion, reported growth of 5.6% YoY, operational growth of 9% YoY, adjusted operational growth of 7.6% YoY.

Cash flows from operations: $16.3 billion, or 2.8-times net income, adjusted cash flows from operations: $5.1 billion, or 0.9-times net income.

Full-year 2023 outlook: GAAP net earnings of $9.42 to $9.57 per share, adjusted net earnings of $10.00 to $10.15 per share, operational sales growth of 8% to 9%, adjusted operational sales growth of 6% to 7%.

Partnerships and other developments: announced a collaboration with Merck to develop and commercialize a long-acting HIV treatment; received FDA approval for its COVID-19 vaccine and began distribution in the U.S.; announced a definitive agreement to acquire Momenta Pharmaceuticals for $6.5 billion; received FDA approval for its Ponvory treatment for relapsing multiple sclerosis; received FDA approval for its Rybrevant treatment for non-small cell lung cancer.

JNJ's share price is down 8.14% year-to-date as of April 25.

Eli Lilly and Company (NYSE: LLY)

Eli Lilly had muted Q4 FY2022 earnings, with revenue declining 9% YoY to $7.30 billion.

COVID-19 antibodies revenue bucked the trend, increasing 5% on the back of volume growth of key growth products.

Regarding products, Eli Lilly's Jardiance® and Jaypirca™ (pirtobrutinib) received positive feedback from the US FDA, paving the way for further development.

LLY stock was up 5.03% YTD as of April 25.

The company will invest approximately $1 billion in a new drug manufacturing facility in Ireland. It had previously committed $500 million to the project.

Merck & Co., Inc. (NYSE: MRK)

Merck's Q4 FY2022 financials came in strong, with worldwide sales increasing by 2% YoY to $13.8 billion. The full-year 2022 worldwide sales totaled $59.3 billion, a 22% increase from 2021.

KEYTRUDA and GARDASIL/GARDASIL 9 were the best-performing products; sales grew 22% YoY each to $20.9 billion for the former and $6.9 billion for the latter.

The company augmented its pipeline in 2022 by acquiring Imago and key agreements with Kelun-Biotech, Moderna, and Orna.

Working with Calvert Research and Management, Barron's named Merck the best pharmaceutical company in Barron's 100 Most Sustainable US Companies 2023.

MRK stock price is up 4.32% YTD as of April 25.

AbbVie, Inc. (NYSE: ABBV)

AbbVie's Q4 FY2022 worldwide revenues were robust, posting a 1.6% increase YoY (reported basis) to $15.121 billion.

The immunology portfolio was the best-performing category, posting a 17.5% growth YoY to $7.925 billion in Q4.

The company announced a collaboration with HotSpot Therapeutics, Inc. to leverage the latter's discovery-stage IRF5 inhibitor program to pursue potential treatments for autoimmune diseases.

The stock price is up 1.05% YTD as of April 25.

Pfizer Inc. (NYSE: PFE)

Pfizer posted over $100 billion in full-year fiscal 2022, an all-time high in the company's history

Paxlovid accounted for much of the growth, posting $18.9 billion in revenues.

Ex-Covid revenue growth is expected to be 7-9% in 2023, driven by potential new launches, newly acquired products, and in-line products.

PFE share price is down 22.14% YTD as of April 25.

Medical devices, equipment, and hospital supplies manufacturers

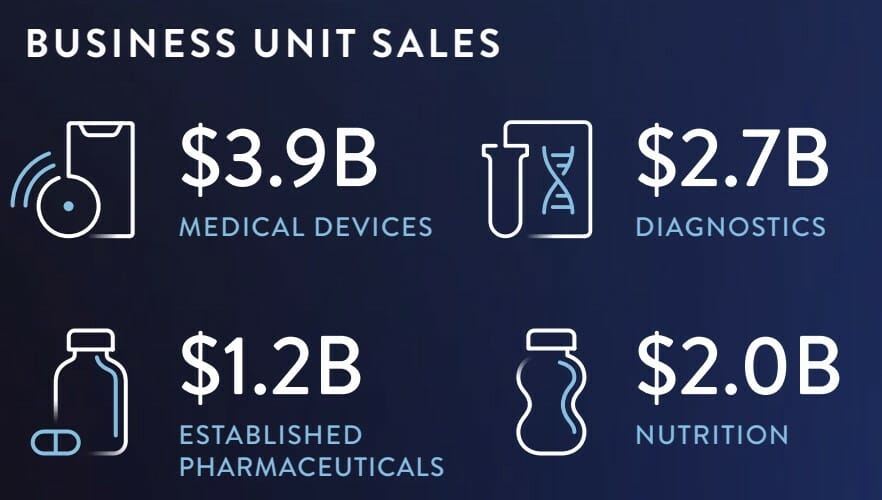

Abbott Laboratories (NYSE: ABT)

Worldwide sales in Q1 FY2023 were $10.5 billion, reported growth of 35.3% and organic growth of 32.9%.

The diluted EPS from continuing operations under GAAP was $0.99 and adjusted diluted EPS from continuing operations grew by 103.1% to $1.32.

Free cash flow grew by 90% to $2.3 billion.

Full-year 2023 outlook: diluted EPS from continuing operations under GAAP of $4.30 to $4.50, adjusted diluted EPS from continuing operations of $5.00 to $5.20, organic sales growth of 10% to 12%

ABT stock price was up 0.75% YTD on April 25.

Stryker Corp. (NYSE: SYK)

Net sales for Q4 FY2022 grew 10.7% YoY to $5.2 billion, and organic net sales climbed by 13.2%.

Stryker's reported EPS declined by 15.0% to $1.47.

Global sales came in at $18.4 billion for the full year 2022; the patients served were over 12,000, and the company now operates in over 75 countries.

The company declared a per share quarterly dividend of $0.75 on February 9 2023, payable April 28 2023.

The share price was up 22.77% on April 25.

Intuitive Surgical, Inc. (NASDAQ: ISRG)

Intuitive released Q1 FY2023 earnings on April 18, 2023 in which it revealed a 14% revenue growth (reported basis) to $1.70 billion.

GAAP net income attributable to Intuitive: $355 million, or $1.00 per diluted share, compared with $366 million, or $1.00 per diluted share, in the first quarter of 2022.

Non-GAAP net income attributable to Intuitive: $437 million, or $1.23 per diluted share, compared with $413 million, or $1.13 per diluted share, in the first quarter of 2022.

Free cash flow: $1.0 billion, compared with $0.7 billion in the first quarter of 2022.

da Vinci Surgical System installed base: 7,779 systems, an increase of 12% compared with 6,920 as of the end of the first quarter of 2022.

da Vinci procedures: grew approximately 26% compared with the first quarter of 2022.

The ISRG stock was up 13.11% YTD on April 25.

Boston Scientific Corporation (NYSE: BSX)

Net sales for Q4 FY2022 were $3.242 billion, a 3.7% YoY growth on a reported basis.

Reported net income (GAAP) was $0.09 per share in the quarter

The company reported net sales growth across all reportable regions and segments except APAC and EMEA.

Several product launches and approvals were reported, including the WATCHMAN FLX device (US), the ACURATE neo2 valve system (Europe), and the AGENT DCB (Japan).

BSX stock price was up 11.58% YTD as of April 25.

Becton Dickinson and Company (NYSE: BDX)

Q1 FY2023 revenue fell by 2.8% on a reported basis but grew by 1.7% on a currency-neutral basis.

Adjusted diluted EPS and GAAP EPS were $2.98 and $1.70, respectively.

The company raised its full-year revenue and adjusted EPS guidance, reflecting the momentum of its BD 2025 strategy and its portfolio of products and solutions.

The company launched BD Prevue™ II System, a new ultrasound device to help clinicians with optimal IV placement.

BD Medical segment continues to generate most of the company's revenue growth.

The share price was up 2.28% YTD on April 25.

Overall, Q1 2023 was a mixed quarter for the top US Healthcare companies. Many companies, including UnitedHealth Group, Merck, and AbbVie, reported strong earnings. However, others like Johnson & Johnson and Elli Lilly missed expectations. All companies made significant M&A and partnership announcements that will shape their strategies for the coming years.

Thank you for reading our Q1 2023 healthcare report. We hope you found it informative and valuable.

Disclaimer: The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our site constitutes a solicitation, recommendation, or endorsement from Healthcare AI News Inc.